Forming an LLC for rental properties can offer notable tax benefits of rental property LLC. These include pass-through taxation, mortgage interest deductions, and depreciation. This article will explain how these benefits work and why they can make an LLC a smart choice for rental property owners.

Key Takeaways

Rental property LLCs benefit from pass-through taxation, allowing income to be reported on personal tax returns, which simplifies tax obligations and reduces overall tax burden.

Tax deductions such as mortgage interest, depreciation, and business expenses significantly lower taxable income, enhancing profitability and cash flow for rental property owners.

Forming an LLC provides legal protections for personal assets and simplifies estate planning, making property transfers smoother while safeguarding against liabilities.

Pass-Through Taxation for Rental Property LLCs

One of the most compelling reasons to form a rental property LLC is the advantage of pass-through taxation. Unlike traditional corporations that face double taxation, rental property LLCs allow income to be reported directly on the owner’s personal tax return. This means that the rental income is taxed only once, at the individual level, simplifying tax obligations and reducing the overall tax burden.

Additionally, avoiding double taxation allows rental property owners to keep more of their income, boosting net profitability. Simplified tax filing, where rental income is taxed like personal income, is a key benefit of an LLC for rental properties.

The Qualified Business Income Deduction lets eligible LLC owners deduct up to 20% of their business income, further lowering taxable income. This deduction can significantly impact overall tax liability, enhancing the appeal of pass-through taxation.

Mortgage Interest Deduction

Another powerful tax benefit for rental property owners is the ability to deduct mortgage interest as a business expense. The IRS permits rental property owners to write off mortgage interest, which can significantly reduce taxable income. This deduction is a substantial relief, as mortgage interest payments can be a considerable part of the expenses in managing rental properties.

Deducting mortgage interest reduces taxable rental income, allowing you to retain more earnings. For example, paying $10,000 in mortgage interest annually can be deducted from rental income, reducing taxable income by the same amount. This helps with tax savings and improves cash flow, enabling reinvestment in properties or covering other expenses.

Form 1098 reports mortgage interest payments of $600 or more to the IRS, ensuring accurate deduction reporting and compliance with tax requirements. Deducting mortgage interest is a significant advantage that can positively impact your rental business’s bottom line.

Depreciation Benefits

Depreciation is another crucial tax benefit for rental property LLCs. These deductions account for the wear and tear on rental properties over time, lowering taxable income. Typically, the depreciation period for rental properties is 27.5 years, with an annual rate of 3.636%, allowing yearly deductions reflecting the property’s gradual decrease in utility.

Forming an LLC can streamline claiming depreciation deductions, particularly beneficial in the early years of property ownership. This enhances cash flow, providing funds for property improvements or other investments.

Depreciation offers tax advantages and plays a crucial role in long-term financial planning for investment properties. Reducing taxable income annually helps maximize net earnings and supports the sustained growth of your rental property business.

Business Expense Deductions

Forming an LLC for rental properties allows for various business expense deductions, significantly lowering taxable income and increasing profitability. Expenses from repairs and improvements to routine maintenance and travel-related costs can be deducted.

Routine maintenance expenses like landscaping, pest control, and cleaning services are deductible. Repairs or improvements for property maintenance can also be written off. Investing in your rental properties allows more deductions from taxable income, creating a win-win situation.

Travel-related costs for property management, such as visiting rental properties or meeting with contractors, are deductible business expenses. Equipment and property rentals for managing properties also qualify. By strategically deducting these expenses, you can optimize tax benefits and retain more rental income.

Capital Gains Tax Deferral

Capital gains taxes are a significant concern for rental property owners, but strategies such as the 1031 exchange can defer these taxes. This strategy allows investors to postpone capital gains taxes by reinvesting proceeds from property sales into similar properties, offering substantial tax advantages.

The 1031 exchange applies to any non-owner-occupied property held for investment, including rental real estate. You can sell a rental property and reinvest the earnings into another rental property without paying capital gains taxes at the time of sale. This deferral aids in growing your real estate portfolio and diversifying investments.

Utilizing a 1031 exchange allows rental property owners to manage tax liabilities strategically, enhancing overall investment strategy and reinvesting more income from property sales into new opportunities.

Separation of Personal and Business Finances

A fundamental benefit of forming an LLC for rental properties is the clear separation of personal and business finances. This separation simplifies accounting and tax reporting, allowing efficient tracking of income and expenses. Maintaining distinct financial records helps identify eligible business deductions and ensures accurate tax filings.

Creating an LLC safeguards personal assets against potential legal claims related to rental properties. In the event of a lawsuit, only business assets are at risk, protecting personal finances from liability. This asset protection offers peace of mind, allowing focus on growing the rental property business without financial exposure worries.

To ensure this protection, keep personal and business finances separate by using a dedicated business bank account and maintaining meticulous financial records. This practice upholds the business structure of the LLC and its liability protections.

Limited Liability Protection

Forming an LLC for rental properties provides robust limited liability protection, shielding personal assets from business liabilities. In the event of a lawsuit or financial claim, only business assets are at risk, not personal wealth. This protection is a cornerstone advantage of the LLC structure, offering peace of mind for rental property owners.

Creating an LLC separates personal liability from business operations, unlike a sole proprietorship. This legal protection keeps personal finances secure, even if the rental business faces legal challenges. For owners with multiple properties, forming separate LLCs for each property can further contain liability risks, ensuring issues with one property do not impact the others.

Compliance with state regulations is crucial for maintaining LLC liability protections. This includes proper business practices, separate financial records, and state-specific filing requirements. Adhering to these preserves the LLC’s integrity and its valuable legal protections.

Simplified Estate Planning

Using an LLC can simplify estate planning for rental property owners. Holding rental properties in an LLC facilitates easier ownership transfer to heirs, bypassing the complex and costly probate process. This streamlined transfer saves time and money, ensuring rental properties pass smoothly to the next generation.

An LLC can help minimize estate taxes when transferring rental properties to beneficiaries. Gradually gifting property interests to heirs manages tax implications more effectively and reduces the overall tax burden. This gradual transfer strategy allows for flexible and tax-efficient estate planning.

The tax deferral benefit of a 1031 exchange can also be utilized for estate planning. This allows assets to pass to heirs without immediate capital gains liability, preserving more property value for beneficiaries. Forming an LLC offers a practical and tax-efficient way to manage the transfer of rental properties as part of an estate plan.

Self-Employment Tax Considerations

A noteworthy tax benefit of forming an LLC for rental properties is avoiding self-employment taxes on rental income. Rental income from LLC-held properties isn’t classified as self-employment income, so it’s not subject to self-employment taxes, resulting in significant tax savings.

Proper accounting for tax obligations is crucial for operating an LLC for rental properties. This includes maintaining accurate financial records and understanding specific compliance requirements. Additional forms like a Schedule C may be necessary, depending on the LLC setup.

Electing to be taxed as an S Corp is a potential tax structure option for LLCs to save on self-employment taxes. This election can provide further tax advantages, allowing rental property owners to optimize their tax strategy and reduce overall tax liability. Understanding and leveraging these tax considerations ensures your rental property business remains financially efficient and compliant with tax regulations.

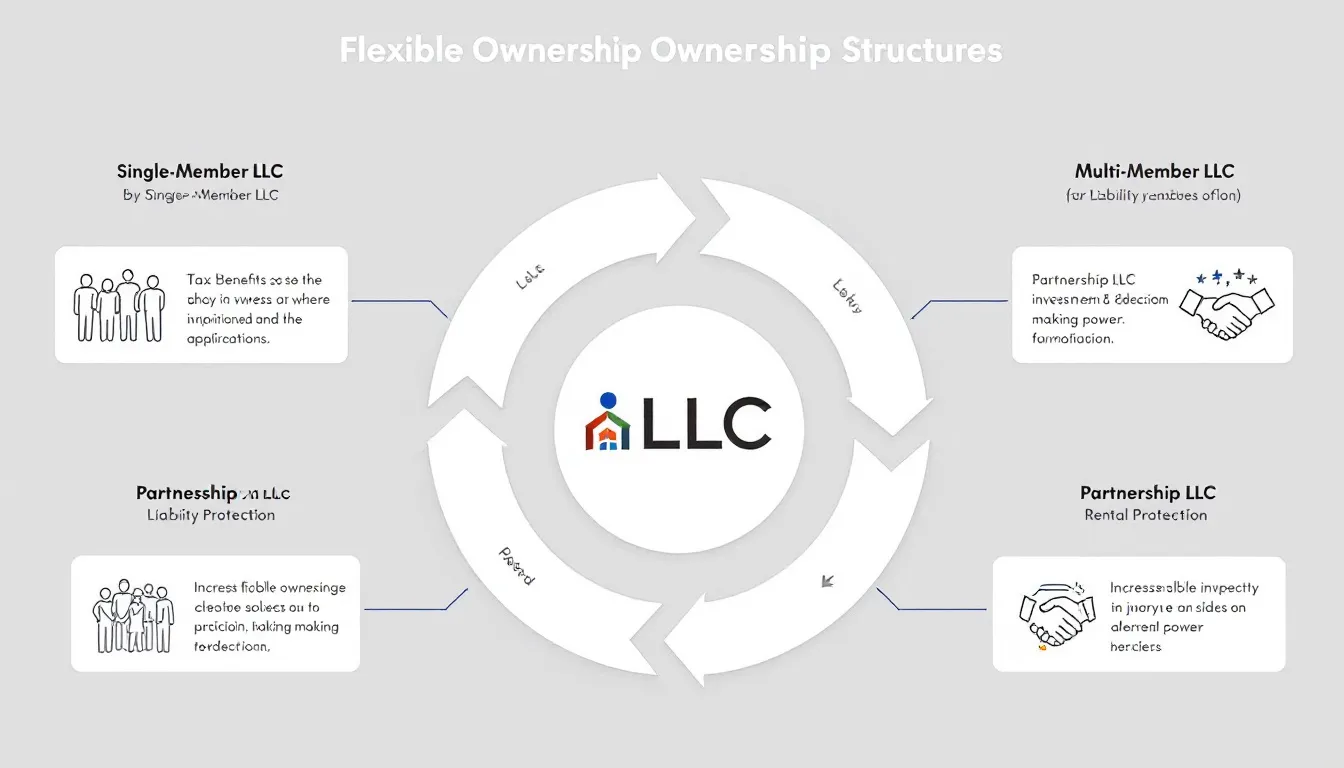

Flexible Ownership Structures

LLCs offer flexible ownership structures that fit the contributions and responsibilities of different members. This flexibility allows multiple members to share profits and responsibilities based on their contributions, simplifying management and growth of your limited liability company rental property business. Clearly defining ownership shares and responsibilities ensures all members are aligned and working towards common goals.

Ownership interests in an LLC can be sold or transferred easily, facilitating smoother ownership transitions. This ease of transferability benefits real estate investors who want to adjust their investment portfolios over time. Allowing varied ownership percentages provides the flexibility needed to accommodate different investment strategies and partnerships.

For property owners with multiple properties, forming an LLC streamlines property management and enhances asset protection. This structure supports efficient and effective management of real estate investments, ensuring all properties are maintained and operated to maximize value and profitability.

Summary

In conclusion, forming an LLC for your rental properties offers a multitude of tax benefits and legal protections. From pass-through taxation and mortgage interest deductions to depreciation benefits and capital gains tax deferral, an LLC can significantly enhance the profitability and security of your rental property business. By separating personal and business finances, providing robust liability protection, and offering flexible ownership structures, an LLC stands out as a powerful tool for rental property owners.

Whether you’re looking to simplify estate planning, avoid self-employment taxes, or optimize your overall tax strategy, an LLC can provide the solutions you need. Consider the benefits outlined in this blog post and explore how forming a Rental Property LLC can transform your investment strategy and provide peace of mind for the future.

Frequently Asked Questions

What is pass-through taxation for rental property LLCs?

Pass-through taxation for rental property LLCs enables owners to report rental income directly on their personal tax returns, thereby avoiding double taxation and simplifying their tax obligations. This structure can enhance financial efficiency for property owners.

Can I deduct mortgage interest for my rental property LLC?

Yes, you can deduct mortgage interest for your rental property LLC as a business expense, effectively lowering your taxable income. This deduction is an important benefit for rental property owners.

How does depreciation benefit rental property LLCs?

Depreciation provides significant benefits to rental property LLCs by reducing taxable income through deductions for property wear and tear, which ultimately enhances cash flow. This financial advantage allows LLCs to reinvest in their properties or improve their operational capacity.

What is a 1031 exchange and how does it defer capital gains taxes?

A 1031 exchange enables real estate investors to defer capital gains taxes by reinvesting the proceeds from the sale of a property into similar properties, thereby postponing the tax liability. This strategy can significantly enhance investment growth potential.

Are rental income and self-employment income treated differently for tax purposes in an LLC?

Rental income from properties held in an LLC is generally not subject to self-employment taxes, while self-employment income is. Thus, they are treated differently for tax purposes, leading to potential tax savings with rental income.

Dave is a seasoned real estate investor with over 12 years of experience in the industry. Specializing in single-family residential real estate, David’s strategic approach combines market analysis, financial acumen, and a deep understanding of urban development trends to maximize investment returns.